Seven asset classes 1-year performance. You might be surprised!!

| October 24, 2023 | October 24, 2024 | 1-Year % Change |

| | | |

| Bitcoin | $34,203 | $68,161 | 99% |

| Silver | $22.86 | $33.70 | 47% |

| NASDAQ | 13,140 | 18,415 | 40% |

| Gold | $1,980.00 | $2,738.00 | 38% |

| S&P | 4,207 | 5,810 | 38% |

| DOW 30 | 32,936 | 42,374 | 29% |

| 1-Year Treasury rate | 5.43 | 4.27 | -21% |

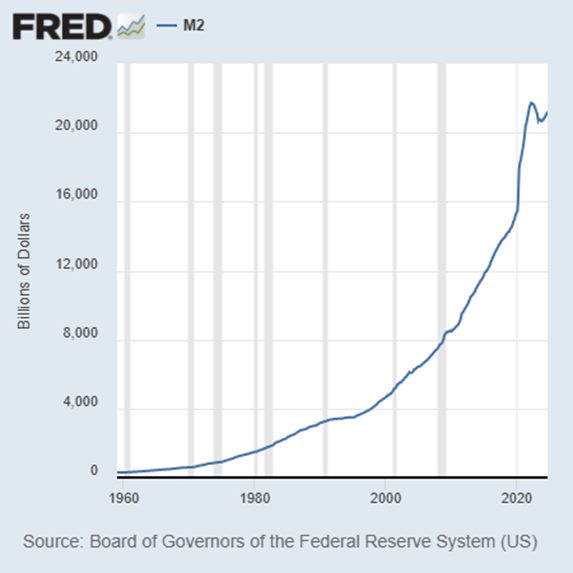

Great returns, right? Well, all the liquidity (money) created by central banks has to go somewhere, right? So, are all these 1 year asset classes performing well in real terms, or does all this money have to find a home? People know that if they keep it in the bank at negative real yields, it is depreciating. Thus, government basically incentives people to buy some asset, any asset with the hope their purchase will outplace inflation, which at its core is M2 (broad money supply) growth.

Money supply growth drives GDP growth – while everyone feels like they are barely treading water or even falling backwards.

What to do?

- Buy precious metals (tangible and private)

- Buy Bitcoin

- Buy technology (the only stock sector I would invest in)

- Buy real estate (do you want the hassle)

- AVOID fixed income and any debt instrument (Bonds, Treasuries and CD’s are debt instruments)

Click here for Pricing