Gold is Ready to Rumble

When you begin to analyze gold in relation to various currencies, including the USD, Canadian Dollar, Sterling, Yuan and Australian Dollars, gold appears to be positioning for strong upward moves. All of the major currencies outside of the USD appear to support a move to the upside for gold.

Here you will find an article by our colleague Ben Drage whom we partner with for Gold and Silver analysis and commentaries. An expert from London, with a Law degree from Oxford University, Ben had a successful brokerage career before branching off to focus on his personal trading. He is well known for his effective use of Median Line Analysis and the power of simplicity in his technical analysis.

While we are focused on the ownership of physical metals, those of you that are engaged or interested in Forex trading will find Ben’s analysis and training to be incredibly useful. Even as physical bullion investors, we find his Gold and Silver market analysis to be of great help as we look to decipher the markets.

Gold across Currencies Looking Ready to Rumble….

Could this be the moment that Gold Bulls have been waiting for? The metal looks to be setting itself up for a strong and sustained move to the upside, not just priced in US Dollars, but also in a number of other currencies. At Forex Analytics we like to take the broader view and we follow Gold and Silver across the wider spectrum. Using Median Line Analysis we take an alternate view of the Markets, eschewing horizontal Supports and Resistances for following the action of price along the lines of our pitchforks.

Chart 1 shows Gold in USD on a 240 minute time frame and anyone looking for horizontal Supports or Resistances would not have had a clue why price turned from the 1262 spike low on Friday. Instead by thinking along the angle of the pitchfork, Chart 2 has proved its worth, not only showing exact Upper Parallel Resistance but also pip-perfect Support $100 away at the circled Lower Parallel. At the time of writing we see the move to the upside held under the green Sliding Parallel where prior Support has, for the time being, become Resistance.

Turning to other currencies and longer time frames, Chart 3 shows Gold on a Weekly basis in Canadian Dollars. Here the trend is very much to the upside with the path of price clearly defined by the lines of the pitchfork. We’ve had four good bounces from the green Sliding Parallel Support and we are currently a very long way from Resistance above. One other thing to note is how price is currently moving higher without the need to revisit the green Sliding Parallel – higher Support in the line of the pitchfork means higher prices ahead, and we will continue to monitor the action.

Chart 4 is Gold in Australian Dollars – this is the only major market where price has been above the 2011 peak, and it did so by a whisker in 2016. Again you can see a line of solid Support shown by the green Sliding Parallel. Resistance is not as uniform as in the Canadian chart above but once again we can discern what looks to be a stepping up in Support. The red arrows show how it looks to have moved higher from the green Sliding Parallel to just under the Quartile of the pitchfork. Again, higher Support means higher prices….

Chart 5 shows Gold in Sterling and though the bullish case is less easy to make here, there is good evidence of strong Support here along the green Sliding Parallel as well as being an argument for saying that price is once again stepping up in Support. Again Resistance in this chart is a significant distance above current levels.

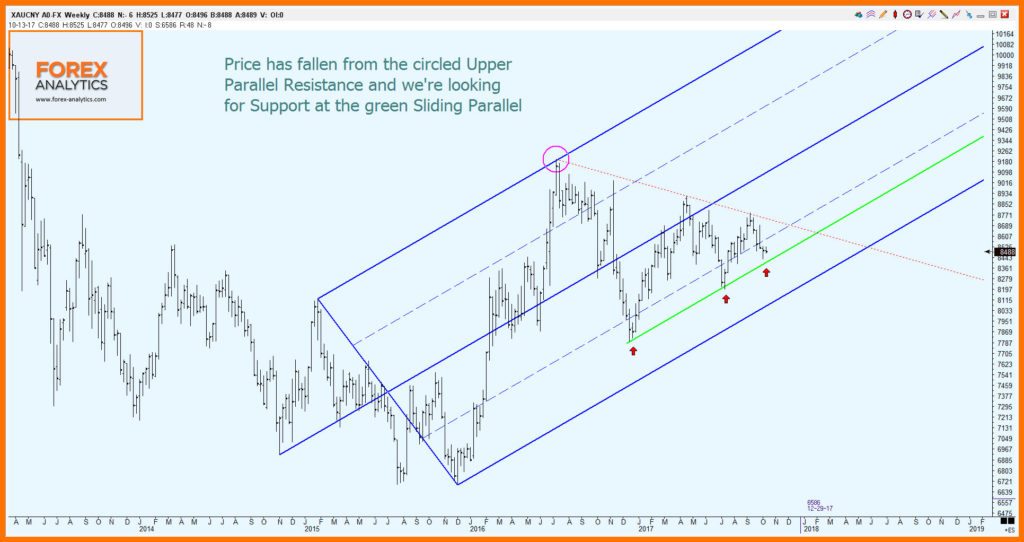

Our final Chart 6 shows Gold in Chinese Yuan where once again we see validation of the pitchfork from the precise Upper Parallel touch and ejection. Once more we find a line of Support in the angle of the fork and note that price is again poised close to this line. Plenty of scope for a move to the upside and little risk to the downside should be welcome news to bulls after seeing Gold in a six year Bear market.

We’ll be following Gold and Silver across various currencies whilst having our main focus on the price in US Dollars. If you would like to find out more about our work and our services please visit the website at www.forex-analytics.com or follow us on Twitter at @ForexAnalytics1 or maybe come along to a free Webinar on Tuesday 7th November at 1pm EST via this Registration link:

https://attendee.gotowebinar.com/register/1866595096696547585