A PICTURE IS WORTH A THOUSAND WORDS

I’ll save the words – you can clearly see for yourself from the pictures. You tell me how this is going to work out!!??

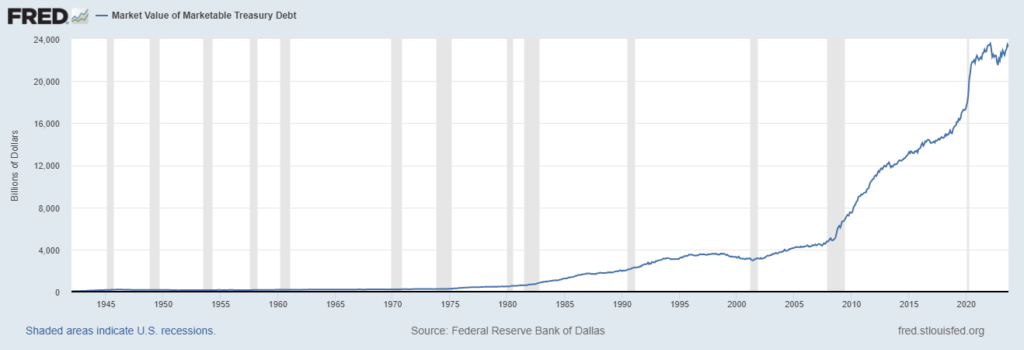

TREASURY DEBT

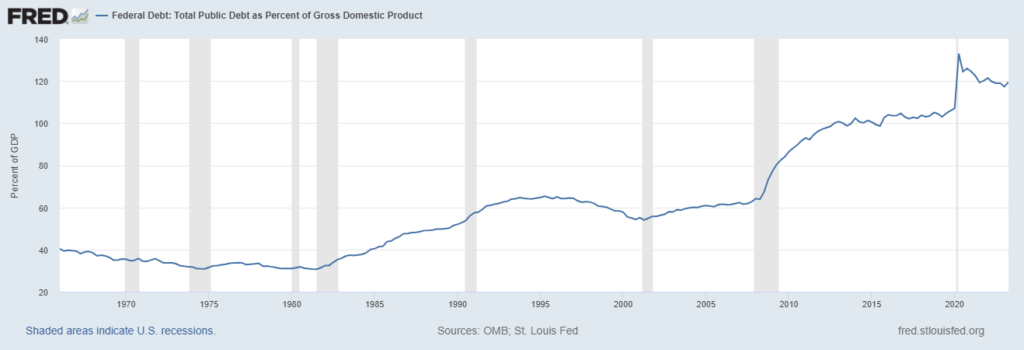

FEDERAL DEBT

– 120% OF GDP (Try to get a personal loan if you already owe 120% of what you are worth)

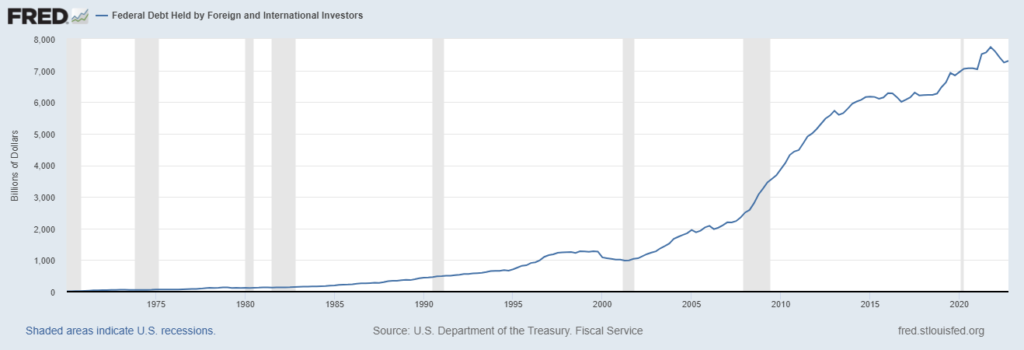

U.S. DEBT HELD BY FOREIGNERS

(can you say BRICS plus Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE)

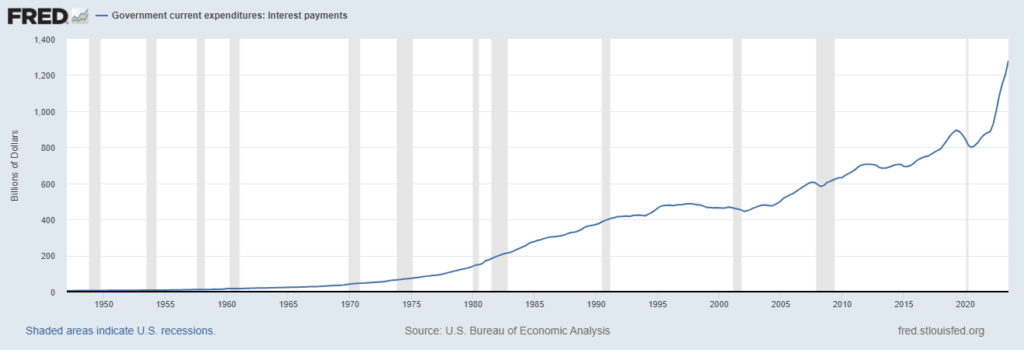

FEDERAL GOVERNMENT INTEREST PAYMENTS

(oh, this is sustainable……)

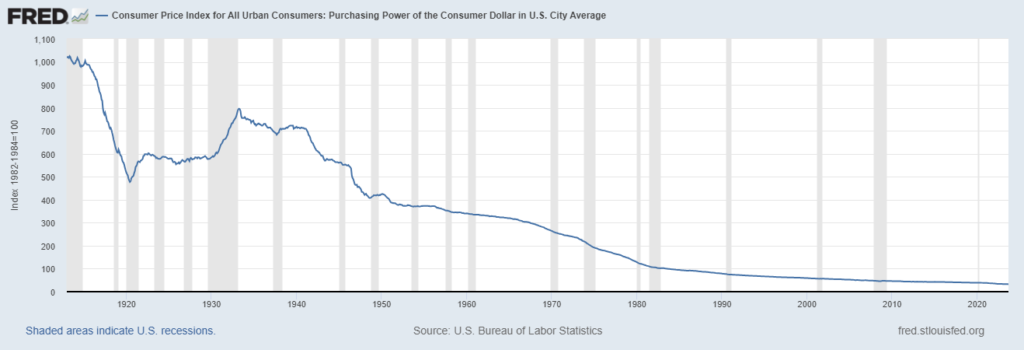

PURCHASING POWER OF THE DOLLAR

– NOW 3.2 CENTS (from creation of the Fed in 1913 until today)

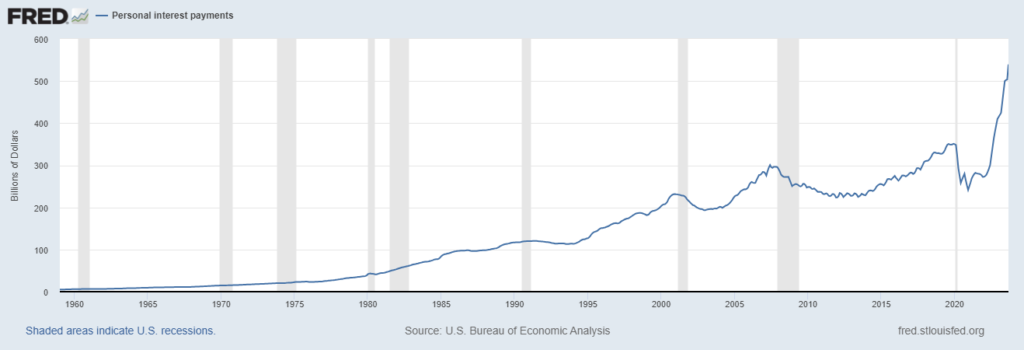

PERSONAL INTEREST PAYMENTS

(the ONLY thing that is keeping this economy going is the consumer, accounting for 70% of GDP. Credit cards, interest rates on which are up dramatically, home equity loans, 401k/IRA hardship loans, student loan deferrals, covid checks, Paycheck Protection Program (PPE) and the list goes on)

Wall Street wants Main Street to think that the Fed and Treasury have it covered, and the landing will be soft. Placate the masses, and if necessary, a good health pandemic and a war or two should help keep them distracted.

KEEP PREPARING – SLOW, BUT STEADY