By: Tim Price, SovereignMan.com

You can see in 2011, the rise in the gold price became overextended relative to the rise in US debt. Then it decoupled and went in the opposite direction.

This is a similar trend to what occurred in the early 1980s. And if one expects that relationship to resume (we do), then gold looks anomalously cheap relative to the rising level of US debt.

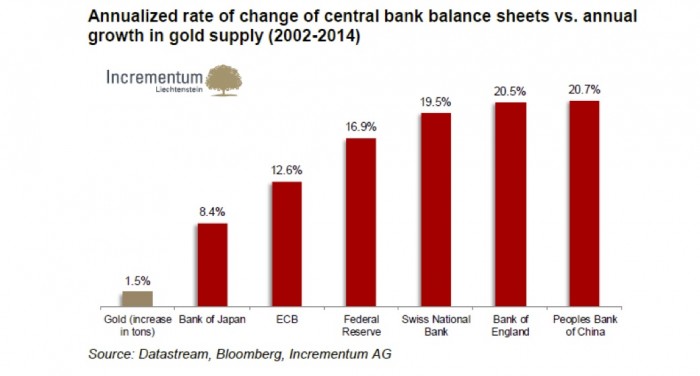

A second rationale for holding gold takes into account the balance sheet expansion of central banks:

You can see in 2011, the rise in the gold price became overextended relative to the rise in US debt. Then it decoupled and went in the opposite direction.

This is a similar trend to what occurred in the early 1980s. And if one expects that relationship to resume (we do), then gold looks anomalously cheap relative to the rising level of US debt.

A second rationale for holding gold takes into account the balance sheet expansion of central banks:

If one accepts that gold is not merely an industrial commodity but an alternative form of money, then it clearly makes sense to favor a money whose supply is growing at 1.5% per annum over monies whose supply is growing up to 20% per annum.

A third rationale for owning gold is best summed in perhaps the most damning statement to capture our modern financial tragedy.

“We all know what to do, we just don’t know how to get re-elected after we’ve done it.”

This is from Jean-Claude Juncker, former Prime Minister of Luxembourg and current President-Elect of the European Commission.

It’s clear there is a vacuum where bold political action should reside. Elected leaders continue to kick the can down the road and ignore dangers to the system.

And in this vacuum, central bankers have stepped in to fill the void via bond yields that are below the rate of inflation.

They say that to a man with a hammer, everything looks like a nail.

To a central banker facing the prospect of outright deflation, the answer to everything is the printing of ex nihilo money and the manipulation of financial asset prices.

This makes it incredibly difficult to shake off the suspicion that navigating the bond markets over the coming months will require almost supernatural powers in second-guessing both central banks and one’s peers.

For what it’s worth this is a game we won’t even bother playing.