Gold is Doing Better Than The World’s Major Currencies

By John Murphy

Editor’s Note: This article was originally published in John Murphy’s Market Message on Friday, July 12th at 11:39am ET.

Gold is more than just a commodity. Gold is sometimes also

viewed as an alternate currency. When global traders lose confidence in their

currency, they often turn to gold as an alternative store of value.

Since gold is quoted in dollars, it rises in value when the

dollar weakens. That’s one way for investors to preserve their wealth when the

Fed starts to lower rates and weaken its currency. Gold recently rose to a

six-year high on falling U.S. interest rates which have weakened the dollar

(aided by a more dovish Fed). So gold is rising in dollar terms. The true

hallmark of a bull market in gold, however, is its ability to rise

relative to other major currencies. And it’s doing just that.

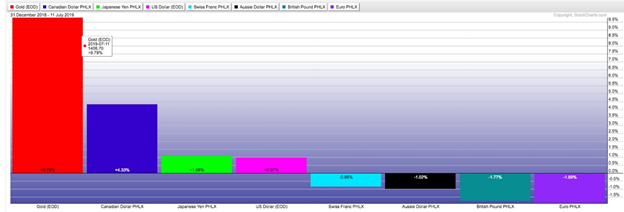

Chart 1 compares this year’s performance in the Gold (red

bar to the left) relative to the world’s major currencies. That includes (in

order of relative strength) the Canadian Dollar, Japanese yen, U.S.

Dollar, Swiss franc, Aussie Dollar, British pound, and the Euro. And it

shows Gold doing better than all of them.

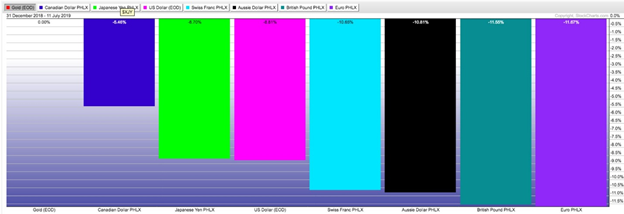

Chart 2 is even more graphic by showing those same

currencies relative to the price of gold which is plotted as the zero line.

Clearly, all of them are losing value relative to gold.

With global growth slowing, central bankers around the world

have taken a more dovish turn toward monetary stimulus which usually weakens

their local currencies. The Fed is the most recent central bank (and the

biggest) to telegraph lower interest rates and a weaker dollar. That may be one

of the main reasons that global traders have turned to gold as a new store of

value. Since gold is a non-interest bearing asset, it also does better when

global rates are dropping.

Chart 1

Chart 2

“The desire for gold is the most universal and deeply rooted

commercial instinct of the human race.”

Gerald M. Loeb