Physical Precious Metals Market is on Life Support – Enter Opportunity

Dealers and wholesalers around the country are reporting extremely slow physical bullion sales. Wholesalers are carrying excessive levels of secondary market coins and bars, the products that have been sold back to them by dealers. This is resulting in the lowering of their bid price, the price they will pay dealers relative to the spot price. Lowering bid prices are occurring almost weekly. The physical precious metals market is on life support right now, for a multitude of reasons.

By “life support” we mean the overall declining sales as measured through the market maker wholesale chain. Some examples that will define the decreasing sales and burgeoning inventory status within the wholesale chain:

1. The bid for common date American Gold Eagles has dropped almost 2%, or $25 per coin since the beginning of 2017. Wholesalers have more Gold Eagles on hand than they know what to do with, and dealers are not buying them. Dealers are not acquiring wholesale Eagles because the public is simply not buying them at their usual pace, and their existing inventory turnover is decreasing.

2. The market for 90% Pre-1965 Silver coins (aka “junk silver”) is even worse. Wholesalers are paying 1 to 2% below spot. There have been times in the past when 90% Silver has sold for as much as 35% over spot. Wholesalers (and dealers) are choking on 90% Silver inventory. We buy 90% Silver from clients and the public almost every day, and are currently selling much less than we usually would. Our inventory continues to grow, with decreasing buying interest from the public.

Why is the physical precious metals market so quiet right now, and what does all of this mean? Let’s look at three charts and I’ll expound at the end.

Brent Crude and Gold

This is a 20-year chart of Brent Crude (black) and Gold. Note how they have largely mirrored each other (the 2008 mania spike in oil being an exception.) Starting in 2015 a divergence began with oil weakening and gold strengthening.

US Dollar and Gold

This is a 20-year chart of the U.S. Dollar Index (green) and Gold. Historically there has been a dance between gold and the dollar. When the dollar is strong, gold is weak and vice versa. We are not at a confluence – almost a battle or showdown.

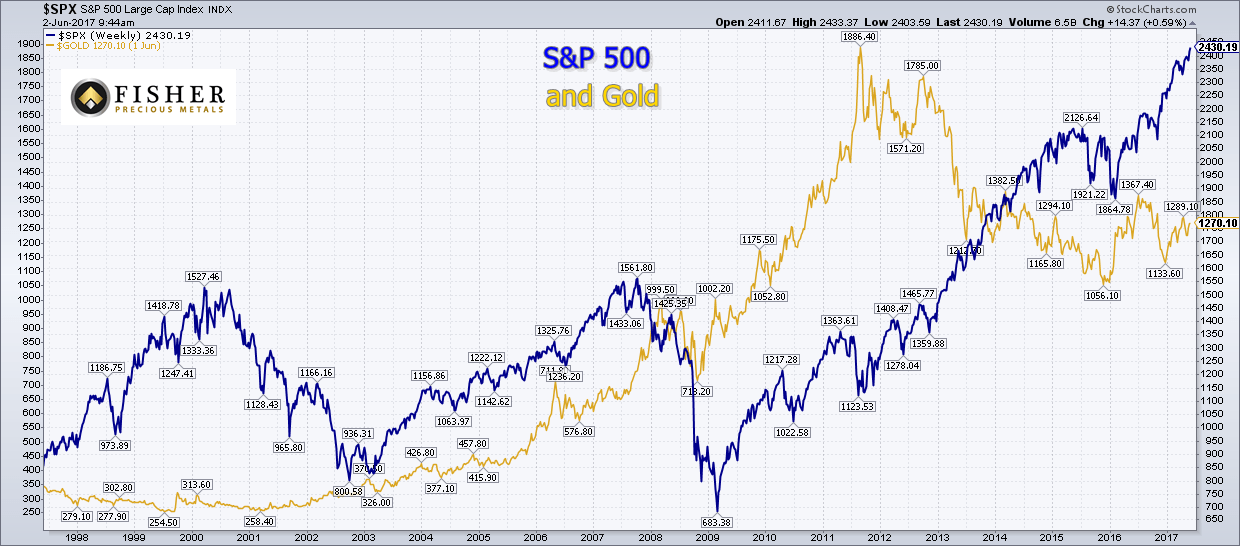

S&P 500 and Gold

Finally, a 20-year chart of the S&P 500 (blue) and Gold. Gold did well while the broad market struggled – until 2013, when the S&P regained its highs of 2000 and 2008. Since then gold has basically been trading sideways for the last four years in a channel between $1,380 and $1,050.

What does this all mean and how does one find relevance in these quiet times in precious metals?

Here are my thoughts:

- There is always a lull before a storm. We are experiencing the quietest time in the metals market in my 21 years in the precious metals industry.

- When things are the quietest – when there is little if any interest in an asset class – prices are usually at, or near, their lowest point.

- Cryptocurrencies are at all-time highs and are garnering increasing investment interest. With hundreds of cryptocurrencies available, they are likely a game changer for the future of all currencies. While revolutionary in nature, they are highly volatile and speculative. What they are NOT, is a store of value or a safe haven investment.

- Crude oil will probably go lower as the Trump administration seeks even greater energy independence and has less concern for the EPA, Paris Accord, pro-pipelines, selling a portion of the strategic energy reserve, promoting coal, etc. Will gold go higher?

- The dollar and gold are battling for favor. My take is that the dollar is going to trend lower. Why? Several reasons. We are losing our place and position as the sole/primary reserve currency (and this pace is accelerating). Trump will use significantly greater amounts of debt to fund infrastructure projects. There is talk of a debt default in October (this is a long shot but it is making dollar holders uneasy). Balance of trade and deficit concerns are increasing.

- Finally, everyone is enamored with the stock market. And why not? Consider the wealth that has been generated. 300% plus in eight years! Many are greedy for more. Others are scared to get in, but an even greater number are scared of missing out. All of the volume and action is in the stock market (and real estate to an extent – although it is consistently beginning to wane). And this market may go even higher. While frothy, we have yet to experience the mania “blow-off the top” that typically occurs, but it will come.

While the physical precious metals industry appears to be on “life support” we are posed with a straightforward opportunity.

What to personally do in precious metals?

- Remember why you bought gold, silver and platinum in the first place. Diversification, privacy, tangible in nature, insurance and profit (as profit is often what is in last place for many buyers’ motivations.)

- Accumulate a minimum 10% holding in physical metals held in your private possession.

- Overweight in silver based on the prevailing gold-to-silver ratio. Also consider platinum which is currently trading $325 below gold, as it has historically traded above the price gold.

- Don’t lose faith. Don’t be deterred. Gold has been desired for thousands of years and it has never defaulted.

- This is the buying opportunity that many of us have waited for. Our truly seasoned clients are buying, typically every 2 to 4 weeks to dollar cost average and gain from this quiet season in precious metals.