The Gold-to-Silver Ratio

The Gold-to-Silver Ratio is a helpful method of interpreting the prices of gold and silver. Often abbreviated as Au/Ag, this ratio represents the amount of silver one can acquire with a single ounce of gold at a given moment in time. While it may seem like a simple comparison, this method is very helpful for people who are new to buying precious metals or have been buying them for a long time.

What is the Gold to Silver Ratio?

The Gold-to-Silver Ratio is calculated by dividing the current price of gold by the current price of silver. For instance, if gold is trading at $2,000 per ounce and silver is trading at $20 per ounce, the ratio would be 100 (2000/20 = 100). This means it would take 100 ounces of silver to equal the value of one ounce of gold.

Historical Significance of The Gold-to-Silver Ratio

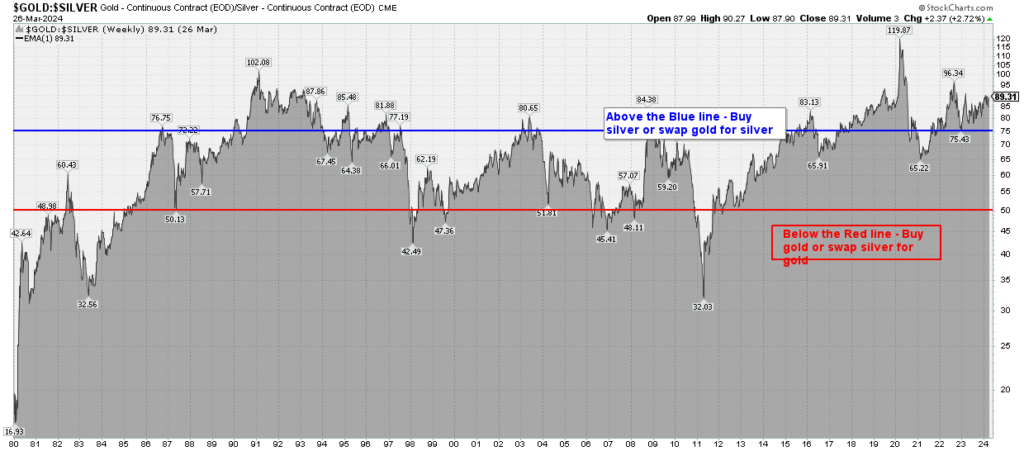

Historically, the ratio has fluctuated significantly over time. While there is no fixed standard, the ratio often ranges between 15 and 100, with occasional spikes and dips outside this range. Throughout history, different cultures and civilizations have placed varying degrees of value on gold and silver. This has led to shifts in the ratio based on supply and demand dynamics, economic conditions, and geopolitical factors.

Interpreting Market Trends-

The ratio is a valuable tool for investors trying to understand market trends and make informed decisions about their precious metals portfolios. A high ratio typically indicates that gold is overvalued relative to silver, suggesting that silver may be undervalued or presenting a buying opportunity for silver investors. On the other hand, if it is lower it may suggest that silver may be overvalued compared to gold, potentially signaling a buying opportunity for gold investors.

Economic and Geopolitical Factors

Several economic and geopolitical factors can influence the ratio. Economic instability, inflation, currency devaluation, and geopolitical tensions can all impact investor sentiment and drive fluctuations in the ratio. For example, during periods of economic uncertainty or geopolitical turmoil investors may flock to gold as a safe-haven asset. This may increase golds price relative to silver and widen the ratio.

Practical Applications

For investors, the Gold to Silver Ratio can inform asset allocation strategies and timing for buying or selling precious metals. Some investors use the ratio to rebalance their portfolios. They may sell gold when the ratio is high or vice versa. Others use the ratio as a contrarian indicator, buying the metal they believe to be undervalued relative to the other.

Conclusion

This ratio is an important metric in precious metals investing. It can provide valuable insights into market dynamics, investor sentiment, and economic trends. That being said it should not be used in isolation to make investment decisions. It is a helpful tool when entering the market and could indicate how the ratio could correct itself in the future. However, it is important to remember that just because something “should” happen doesn’t mean it will happen. It is impossible to predict the future of the precious metals market perfectly.