Will Gold and Silver Go Lower?

Will gold and silver go lower? In a word – possibly. What would cause the metals to go lower?

Further hikes by the Fed make interest bearing instruments more attractive (Treasuries, CD’s, money market funds, etc.). Metals do not pay any interest (yield).

The DOW is negative for the year – people are moving to cash. And when they move to cash, they do so indiscriminately. This includes moving their paper precious metals holdings (ETF’s, futures, options, mutual funds, derivatives, etc.) to cash. Most of the precious metals market capitalization is held in these instruments. Physical holdings are only a small percentage – and physical holders typically do not sell.

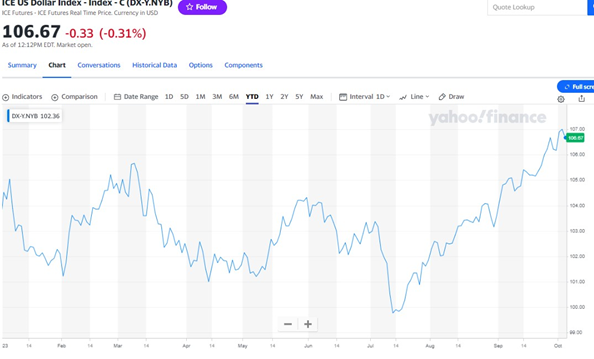

The dollar index is at a high for the year, despite a huge expansion of the money supply, burgeoning

debt, downgrades by Moody’s and Fitch (with other rating institutions considering the same), BRICS gaining traction, BRICS expansion on the horizon, the executive and legislative branches in turmoil – the list goes on and on. Yes, in the end, the dollar is the best piece of garbage on the planet. At least for now.

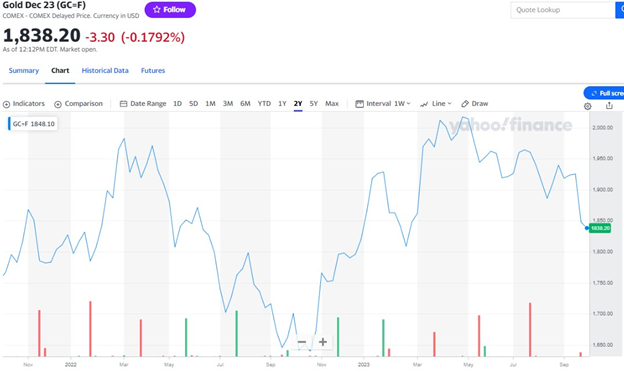

Gold could go back to the $1650 range. Do not believe anyone who tell you it is not possible. When it did in 2022, six months later it had risen to $2050, a $400 or 25% move.

Will it go that low? Maybe. Who knows? If you are a gambler you can wait and see if you can catch the “falling knife”. Will it go back to $2050 and then some, absolutely. We all know

that. So, what are you going to choose – the gamble or the sure thing.

Bottom line – we do not know how low for how long. We do know highs and higher highs will return. In the end, years from now, it will be more important to have your position (accumulated the ounces / dollar value) you want, than to have gotten faked out by price fluctuations and come up short. Dollar-cost average in modest, regular amounts. That is what I do – picking highs and lows has never worked for me.